India’s export ecosystem is going digital, but not all exporters keep pace. The ones staying ahead? They’re powered by RBI-approved payment aggregators. As global trade grows more complex and compliance norms tighten, working with a trusted export payment partner is no longer a nice-have. It’s a must. What was once optional has become imperative.

Choosing the right export payment aggregator can make all the difference between frustrating delays and fast, compliant growth, whether you are just starting out or expanding internationally. Exporters who are future-ready in 2025 will not only be digital, but also strategically think about how they will be paid.

What is a payment aggregator?

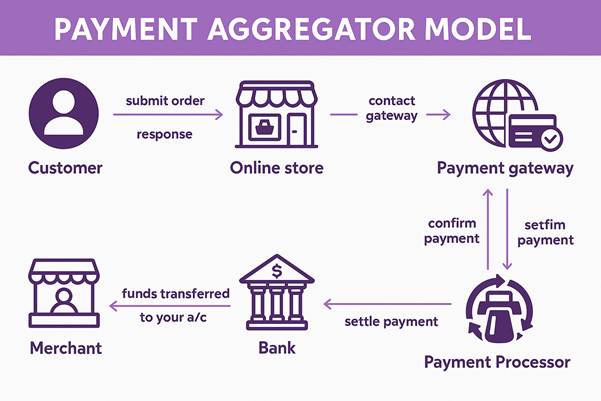

The payment aggregator (PA) is an intermediary that allows businesses to accept payments without opening a merchant account with a bank. Payments are instead received, processed, and settled into the business’s account by the aggregator.

A payment aggregator facilitates the following in the export context:

- The collection of international payments from foreign buyers

- Conversion of foreign currency and settlement in Indian rupees

- Compliance with RBI, FEMA, and GST regulations

It is important to keep in mind that not all payment aggregators are the same.

What exporters need to know about RBI approval

As the digital payments landscape evolves, RBI approval is now a regulatory requirement. To ensure adequate oversight and security, all non-bank entities handling export payments must hold valid licenses from the Reserve Bank of India (RBI). Payment gateways that are not RBI-approved (PA or PA-CB license) may put you at risk of non-compliance and real consequences.

Here’s what RBI-approved payment aggregators ensure:

- The RBI, FEMA, and Income Tax laws are all in compliance with the law

- A secure fund collection process and a timely settlement procedure

- The automatic generation of Foreign Inward Remittance Advices (FIRAs)

- Sync export documentation seamlessly with EDPMS (Export Data Processing and Monitoring System)

- FX conversions that are transparent and free from hidden fees

In the absence of RBI approval, there’s a high likelihood that your bank will delay, flag, or hold your payments. When it comes to navigating international markets, working with a compliant, RBI-approved payment aggregator is not just safer, it’s smarter.

What is a PA-CB License?

Payment Aggregator – Cross Border (PA-CB) is a special category of RBI license issued to payment aggregators that facilitate international payments on behalf of Indian exporters.

Export payment aggregators licensed by the PA-CB provide the following services:

- They collect foreign currency proceeds from exports

- Funds are converted and settled to the exporter’s Indian bank account in INR

- Their policies and procedures ensure that GST, FEMA, and RBI regulations are adhered to

- Shipping bills are uploaded to EDPMS and FIRAs are generated

Due to this, PA-CB licensed PAs are necessary for exporters, SaaS providers, freelancers and other parties remitting remittances internationally, as well as marketplaces and aggregator platforms facilitating global sales from India.

Export Payment Aggregators vs. Traditional Banks

| Feature | Traditional Bank | BRISKPE |

| Licensing | Bank-regulated | RBI PA/PA-CB Licensed |

| Onboarding | Complex & slow | Digital-first & fast |

| FX Rates | Often marked up | Transparent and close to market |

| FIRA Generation | Manual, delayed | Instant or automated |

| EDPMS Support | Manual upload | Automated mapping |

| Settlement Time | T+3 to T+7 | As low as T+1 or same day |

A cross-border payment partner that’s RBI-approved can drastically reduce your operational load while ensuring 100% regulatory compliance.

What Exporters Need to Know About RBI-Compliant Payment Partners

Non-compliant aggregators or direct SWIFT transfers can technically be used by exporters, but these approaches often introduce operational and compliance risks that negatively affect cash flow.

The following are some of the most common challenges:

- Payment settlements are delayed or blocked due to regulatory scrutiny

- There are data discrepancies between the shipping documentation and the EDPMS entries

- An incomplete or inaccurate FIRA generation results in a GST input credit that has been missed

- The markup on foreign exchange is high and the fees are not transparent

Here are some of the benefits export payment aggregators can provide

Payment aggregators that are RBI-compliant provide exporters with a significant advantage in terms of efficiency, compliance, and cost management.

There are several key benefits, including:

- The ability to access working capital more quickly thanks to faster settlements

- Fees as low as 0.75% per transaction, resulting in lower transaction costs

- Real-time dashboards for better financial oversight and centralized reporting

- Reconciliation with GST, FIRA, and export documentation automatically, reducing manual intervention and errors

What to Look for in an Export Payment Aggregator

Before you choose your export payment gateway in India, consider the following:

- Status of RBI PA-CB license (check RBI’s official website)

- The ability to collect and convert foreign currency payments

- FX rate transparency and real-time monitoring

- Automated FIRA + EDPMS integration

- Documentation and invoices that are GST-compliant

- A transparent pricing model without hidden costs

- A dedicated exporter support team

Final Thoughts: Compliance Is the New Currency

Indian exporters can no longer afford to treat payment infrastructure as an afterthought.

The RBI’s tighter licensing norms signal a shift toward secure, traceable, and tax-compliant international trade. Whether you’re a product exporter, a digital service provider, or a freelancer, your choice of export payment aggregator directly affects your bottom line.

Choose an RBI-approved payment partner who understands your market, simplifies your paperwork, and maximizes your returns.

Frequently Searched Questions

Q1: Is BRISKPE an RBI-approved export payment aggregator?

Yes. BRISKPE is in line with RBI’s PA/PA-CB licensing framework and enables fully compliant international settlements for exporters.

Q2: Can I receive AED, USD, EUR through payment aggregators?

Absolutely. Top cross-border payment partners allow exporters to receive funds in multiple currencies and convert them into INR seamlessly.

Q3: What documents are needed to onboard with a payment aggregator?

Typically: IEC code, GSTIN, bank details, KYC documents, and shipping invoices.