In 2025, the global payments infrastructure is evolving faster than ever. Real-time payments are no longer a dream; they’re an expectation. From exporters in Mumbai to Importer is EUROPE. Global customers now demand faster, cheaper, and transparent cross-border payments powered by instant payment rails and domestic payment networks.

Yet for most banks, the systems driving international money transfers still depend on legacy infrastructure-built decades ago slow, complex, and expensive to maintain. That’s about to change. Introducing BRISKPE XPI, a next-generation Cross-Border Payment Infrastructure that enables banks to modernize payments, connect to domestic instant payment networks, and move money globally faster and smarter.

This isn’t just an upgrade. It’s a revolution in financial and fintech infrastructure, designed to make global transactions seamless, compliant, and near instant without forcing banks to rebuild their global payments systems from scratch.

The Legacy Problem: Why Banks Need to Evolve

For decades, banks have been the backbone of global trade, powering trust, compliance, and reliability across borders. But the international banking system that once defined efficiency is now showing its age.

Traditional cross-border payments still rely on SWIFT-dependent networks, where every transfer passes through multiple intermediary banks before reaching its destination. Each intermediary adds processing time, hidden fees, and layers of compliance checks often without real-time visibility into the transaction journey.

Behind the scenes, every global transaction touch multiple system within a bank:

- Core Banking Systems managing accounts and balances

- Trade Operations handling documentation and regulatory checks

- Online Banking Platforms serving customer interfaces

- Transaction Monitoring Systems screening for AML and compliance

- Document Management Systems storing KYC, invoices, and proofs

While these functions are vital, they often work in isolation, creating silos that block real-time payment processing and slow down the overall cross-border money movement. To make matters worse, most banks lack local collection accounts in foreign markets, limiting their ability to settle or receive payments directly. This dependence on correspondent banking networks adds complexity, increases costs, and weakens transaction transparency.

The result?

- Payments take days to settle

- Costs multiply with every intermediary

- Transparency fades across the chain

But the new era of financial infrastructure works differently. Collections now happen locally, reducing the need for intermediary chains. SWIFT dependency is minimized or replaced by interoperable digital payment rails. Automated compliance monitoring reduce manual checks. And same-day settlements have become the new global standard.

Banks don’t need to rebuild from scratch; they simply need to evolve with the right technology that makes their existing systems smarter, faster, and future ready. That’s where BRISKPE XPI comes in helping banks transition from legacy fragmentation to seamless, modern interoperability in cross-border payments

Enter BRISKPE XPI – Redefining Global Payment Interoperability

Cross-border payments are evolving faster than ever, but the systems supporting them haven’t kept up. For most banks, achieving true real-time money movement still feels like trying to run a modern marathon in legacy shoes. That’s exactly what BRISKPE XPI aims to change.

Built for banks and financial institutions, BRISKPE XPI (Cross-Border Payment Infrastructure) is a unified API layer that modernizes legacy payment systems and enables real-time cross-border transactions without forcing a complete rebuild. It preserves what banks do best: trust, compliance, and control, while powering what today’s world demands speed, transparency, and interoperability.

By connecting directly to BRISKPE’s global payment network, XPI enables instant settlements, smarter routing, and automated compliance all within one secure, scalable, and future-ready framework. In simpler terms, think of XPI as the missing bridge between traditional banking systems and the new era of digital payments and financial infrastructure.

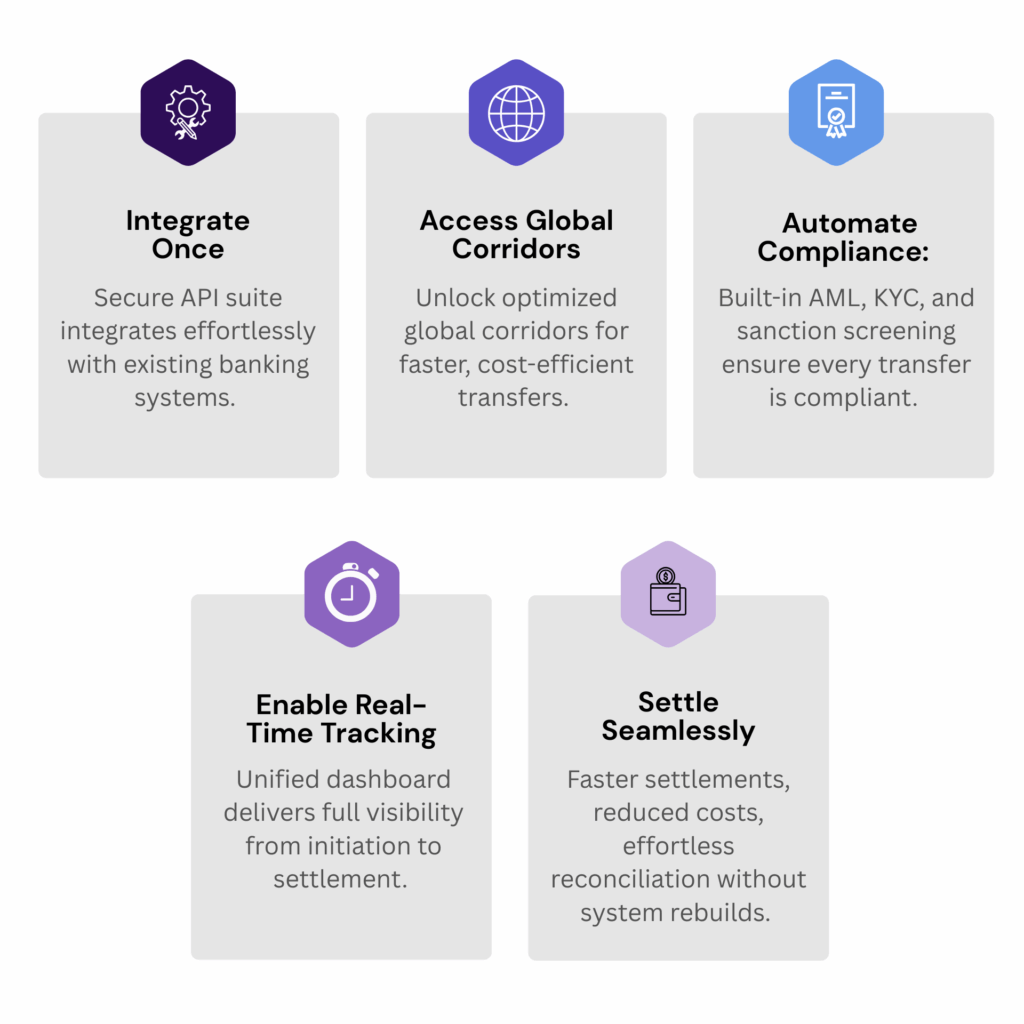

The XPI Framework: Built for Banks, Engineered for Scale

Modern cross-border payment infrastructure demands more than speed; it requires interoperability, automation, and scale. The BRISKPE XPI Framework brings all three together, empowering banks to modernize how global transactions are collected, processed, and settled.

1. Collection Layer — Multi-Rail, Multi-Partner Capabilities

Seamlessly collect payments through account-to-account (A2A) transfers or card-based collections across multiple currencies and corridors. With BRISKPE XPI, banks can connect to a wide network of collection partners and onboard new ones on demand. This multi-rail architecture enables flexible scaling in response to market demand and evolving customer needs a critical edge in the era of real-time cross-border payments.

2. Middleware — The Intelligence Core

At the heart of the framework lies BRISKPE Middleware, the intelligence layer that powers automation and compliance.

It’s a pre-built orchestration engine that automates:

- Client onboarding and KYC verification

- Transaction monitoring

- AML and sanction screening

The result is a payment process that’s compliant, transparent, and regulator-ready, all without manual overhead. This compliance automation gives banks a faster route to regulatory confidence while reducing operational friction.

3. Payout Layer — Adaptive and Efficient Settlements

Once transactions are cleared, BRISKPE XPI routes payouts through multiple AD-I partner banks, depending on client preferences and corridor requirements. This intelligent routing ensures same-day settlements, improved liquidity management, and fewer bottlenecks across markets helping banks achieve faster, cheaper, and more transparent cross-border transactions.

The BRISKPE XPI Flow: How It Works

BRISKPE’s end-to-end architecture streamlines international money movement through a seamless, secure, and fully compliant workflow. It works in five simple steps, as shown below

Connect -> Comply -> Settle: The BRISKPE XPI Flow

Powered by BRISKPE XPI, The Future of Cross-Border Payment Infrastructure

Why This Is a Breakthrough for Banks

The cross-border world is evolving faster than ever, and BRISKPE XPI helps banks lead that evolution, not chase it. This isn’t disrupting its transformation built for the new age of global payments infrastructure. XPI empowers banks with tools and intelligence to compete at fintech speed, backed by bank-grade compliance, trust, and transparency.

1. Built for Banks, Not Against Them

BRISKPE XPI doesn’t compete with banks; it enhances them. It strengthens what already works: regulatory compliance, customer trust, and long-standing central bank relationships, while adding the agility of fintech infrastructure and payment modernization. The result? A future-ready bank–fintech partnership that delivers seamless global transactions, better efficiency, and a truly competitive advantage for banks.

2. Speaks the Language of Compliance

All the Onboarding and Transaction APIs running through XPI are wrapped in automated AML, KYC, and sanction screening, aligned with global and domestic regulatory frameworks. This ensures scalable compliance, enabling banks to stay compliant by design while reducing operational overhead and manual audits and risk management in payments.

3. Fast. Flexible. Scalable.

Launch new payment corridors or multi-currency payments in days, not months.

XPI’s modular architecture enables banks to go live 3× faster and at one-third the cost of traditional builds. It’s speed with structure leveraging API integrations for payments and instant payment rails to achieve true payment innovation and global connectivity.

4. Visibility and Trust, Restored

Real-time payment tracking. Transparent pricing. Instant reconciliation.

With BRISKPE XPI, banks can offer their clients what matters most clarity, control, and customer trust. Every cross-border transaction is visible from initiation to settlement, ensuring real-time visibility, enhanced efficiency, and reduced operational costs. It’s how banks rebuild trust in the era of global payment systems powered by transparency, automation, and collaboration in financial services.

Real Transformation: From Friction to Flow

With BRISKPE XPI, banks can modernize their cross-border payments and participate in the digital transformation in banking without rebuilding legacy systems. By integrating seamlessly with instant payment rails and domestic payment networks, XPI simplifies complex global transactions into a single, intelligent global payments infrastructure.

It helps banks achieve:

- Lower internal costs for international money transfers

- Reduced customer fees through cost-efficient transfers

- Fewer intermediaries, enabling faster processing times and real-time visibility

This is not disruption; its payment modernization built for scale, efficiency, and trust.

Business Impact: Turning Cross-Border from a Cost Center to a Growth Engine

Banks leveraging BRISKPE XPI can convert operational complexity into strategic growth through API integrations for payments and operational automation.

- Accelerated Settlements: Transform multi-day transfers into same-day or real-time payments, powered by faster payment networks and direct corridor access.

- Operational Efficiency: Streamline reconciliation and compliance with scalable compliance frameworks.

- Enhanced Customer Experience: Deliver predictable, transparent global payment systems for exporters, MSMEs, and corporates.

- New Revenue Streams: Expand multi-currency payments and new corridors through bank–fintech partnerships and global partnerships in payments.

- Future-Ready Systems: Stay compliant with ISO 20022, regulatory compliance standards, and central bank relationships as the global economy evolves.

By combining agility with compliance, BRISKPE XPI turns cross-border transactions into a competitive advantage for banks.

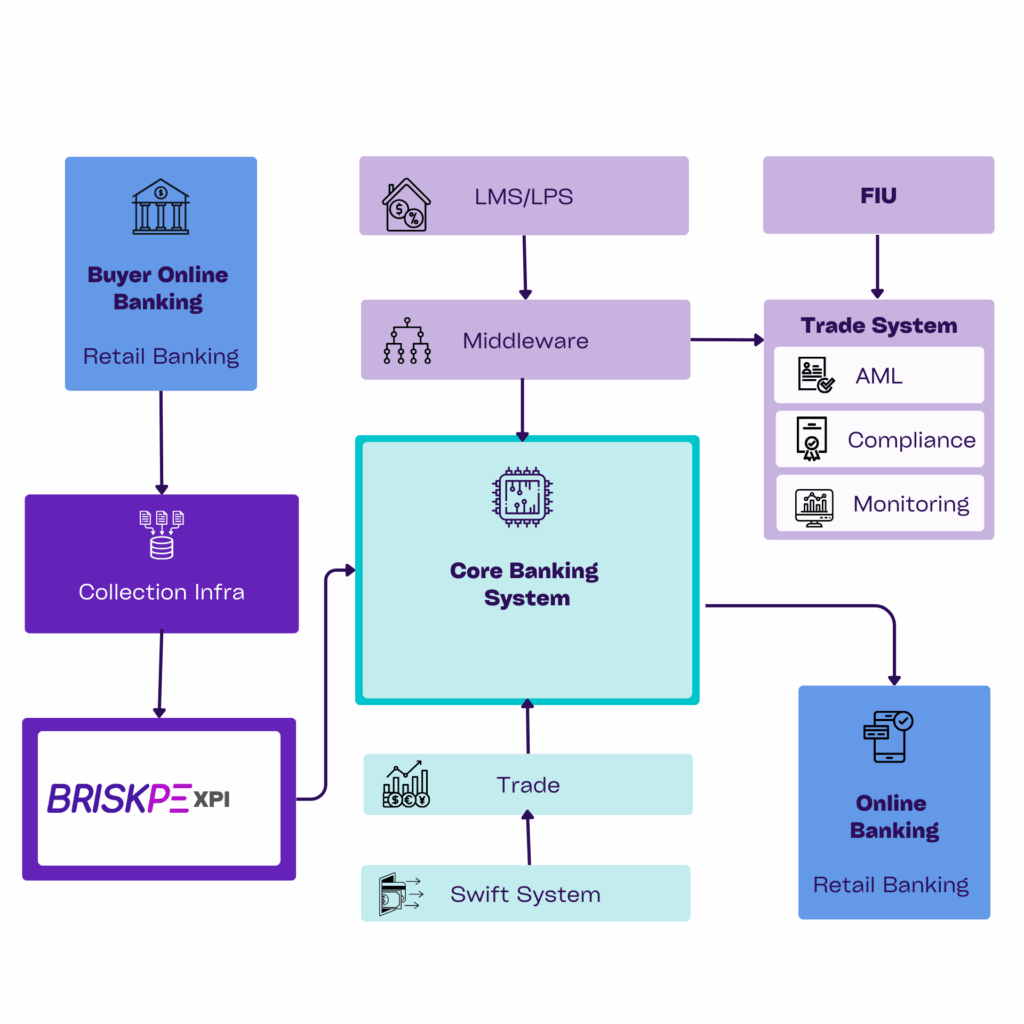

BRISKPE XPI: The Intelligent Bridge Between Banking Systems

The diagram represents how BRISKPE XPI integrates into a bank’s ecosystem, acting as a middleware layer that bridges collection data, trade systems, and the core banking system (CBS) enabling cross-border trade payments and compliance flows.

Detailed Flow Explanation

1. Inbound Data Capture and Integration

- Collection Info → BRISKPE XPI

- This module represents the inflow of payment or collection of details from external or domestic systems (e.g., PSPs, marketplaces, and payment aggregators).

- BRISKPE XPI receives these inputs through APIs, validating payer information, amount, and compliance parameters.

- Banking Mobile App → BRISKPE XPI

- The bank’s front-end channels (mobile/online apps) connect to BRISKPE XPI for customer-initiated trade payments or collections.

- BRISKPE XPI exposes APIs for account validation, reference mapping, and transaction acknowledgment back to the bank’s UI.

2. Processing Layer – BRISKPE XPI

- Acts as the middleware orchestration engine.

- Performs:

- Trade Payment Routing – Determines whether transactions are inward or outward remittances and applies correct purpose codes.

- Compliance/AML Triggers – Pushes KYC/transaction data to trade systems for risk assessment.

- API-based Posting – Transmits validated transactions to the CBS (Core Banking System).

3. Core Banking System (CBS)

- The central transactional hub manages all customer accounts, settlements, and GL entries.

- Receives trade payment instructions from BRISKPE XPI and posts corresponding debit/credit entries.

- Interfaces with:

- SWIFT System – For cross-border trade payment messaging (MT103, MT202).

- Trade Systems – For compliance, AML, and monitoring processes.

- Retail/Online Banking – To display trade transaction status and statements to end users.

- LMS/LPS (Loan or Liability Processing Systems) – For integrating trade finance products.

4. Trade Systems

- Includes:

- Compliance Engine – Validates trade documents, IEC, purpose codes, and sanctions.

- AML Monitoring – Flags for suspicious or threshold-breaching transactions.

- PIU (Payment Information Unit) – Maintains reporting standards for regulatory submissions (EDPMS, IDPMS, FIU).

- These systems interact with both upstream (XPI → CBS) and downstream (CBS → Trade Systems) to ensure full regulatory and operational closure.

5. SWIFT System

- Used for external communication to correspondent banks.

- Sends trade-related payment messages from CBS, completing the outward remittance process.

- Receives confirmation messages (e.g., MT199, MT999) that flow back into CBS and then through XPI to update transaction status.

6. Middleware Cloud Layer

Typically handles authentication, queue management, and logging for all integrations.

Represents API gateway, message broker, or microservices environment (possibly bank-hosted or cloud-based) that ensures secure, scalable data flow between CBS and XPI.

Enhancement Recommendations (for Tight Coupling of CBS & Trade Systems with BRISKPE XPI)

1. Real-Time API Integration

- Replace or supplement batch uploads with REST/ISO-20022 APIs between:

- XPI ↔ CBS (for posting, status, account inquiry)

- XPI ↔ Trade Systems (for compliance checks, purpose code validation)

- Implement bi-directional data sync via webhooks or event streaming (Kafka/AMQP) to reduce reconciliation delays.

2. Middleware Enhancement

- Introduce an Enterprise Service Bus (ESB) or API Gateway to centralize routing between BRISKPE XPI, CBS, and Trade modules.

- Define message schemas aligned to ISO-20022 standards for trade and remittance data.

3. Unified Customer Reference (CRN/UCIC) Mapping

- Maintain a shared master key across XPI, CBS, and Trade Systems.

- Enables instant lookup for compliance, AML alerts, and FIU mapping without manual reconciliation.

4. Compliance Hook Automation

- Automate KYC, sanctions, and EDPMS/IDPMS validations within XPI before CBS posting.

- Push structured responses (OK/Reject/Error) back to CBS in real time.

5. SWIFT Message Parser within XPI

- Add SWIFT MT message parsing capability to XPI so that CBS doesn’t need manual tagging for trade credits/debits.

- Enables faster updates on remittance confirmation and auto-closure of trade entries.

6. Monitoring & Reconciliation Dashboard

- Extend XPI to host a transaction monitoring and reconciliation layer that continuously matches:

- XPI → CBS transaction IDs

- CBS → Trade reference IDs

- CBS → SWIFT confirmation IDs

7. Cloud-Native Deployment

- Containerize XPI and middleware components (via Docker/Kubernetes).

- Use message queues (e.g., RabbitMQ/Kafka) for guaranteed delivery between systems.

- Enable CBS and Trade Systems to consume these APIs through secured VPC peering.

Result:

- Near real-time settlement and compliance sync

- Instant visibility for CBS and Trade Systems

- Reduction in manual reconciliations and file-based delays

- Bank + Fintech synergy with high scalability and auditability

Future-Ready for the Next Decade of Finance

As global payment systems shift toward open banking, CBDCs, and interoperable finance, BRISKPE XPI offers legacy system modernization without costly rebuilds.

Its modular, compliant architecture supports partner-led growth and collaboration in financial services, enabling banks to adapt instantly to new corridors, currencies, and frameworks.

It’s a foundation for payment innovation that combines enhanced efficiency with reduced operational costs positioning banks to lead in a $12 trillion cross-border opportunity.

Partnering for Progress

The future of global connectivity in finance depends on cooperation, not competition.

BRISKPE XPI strengthens cooperative banking models and creates a bridge between traditional banks and modern payment providers.

This isn’t about replacing banks; it’s about enabling collaboration beats building from scratch through agile partnerships and shared growth.

When banks and fintech’s collaborate, the result is faster, smarter, and more inclusive of international banking solutions that benefit businesses and customers alike.

Let’s Redefine Cross-Border Banking

With BRISKPE XPI, banks can:

- Enhance transparency and efficiency in cross-border payments

- Strengthen regulatory compliance and risk management

- Unlock new corridors through bank–fintech partnerships

- Deliver next-gen seamless global transactions

BRISKPE XPI – transforming global payments through fintech collaboration.

Connect with BRISKPE today to explore how your bank can evolve faster, scale smarter, and lead the next era of global finance, Click Here