Cross-border payments are the invisible lifelines of global trade. Every time a business in India ships textiles to the US, or a software developer invoices a client in Europe, money must move across borders. Yet, for decades, this process has been slow, opaque, and frustrating.

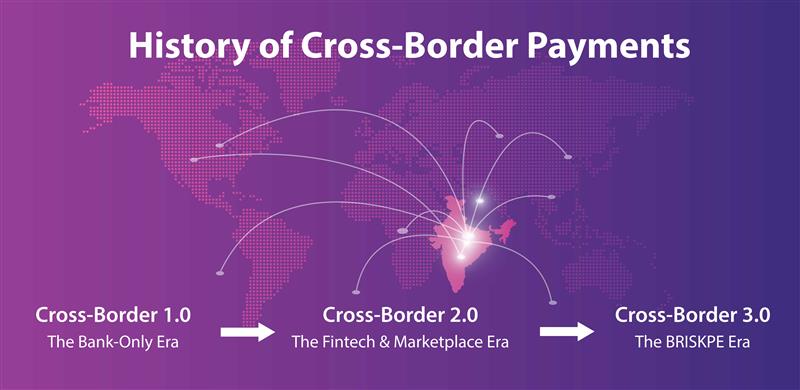

What makes the story of cross-border payments fascinating is how it evolved over the years, first dominated by banks, then disrupted by global payment players, and finally reshaped by compliance and technology. At the heart of this story is the rise of a new generation of Indian solutions, with BRISKPE leading the charge.

Let’s walk through this journey.

Cross-Border 1.0: The Bank-Only Era

Not long ago, banks were the only gatekeepers of international trade. If an exporter in Tiruppur shipped garments to London, the payment had to travel through the traditional SWIFT network, pass multiple intermediary banks, and finally land in the exporter’s Indian bank account.

While the system technically worked, it was far from efficient, and exporters often bore the brunt:

- Delays: Settlements typically took 7–10 days, sometimes longer if paperwork was incomplete or intermediaries were slow. In a world where supply chains were becoming faster and more dynamic, a week-long wait could be costly.

- Opacity: Exporters had little to no visibility into the payment journey. Once the money left Buyer’s account, exporters were largely in the dark—wondering whether it was stuck at a correspondent bank in London or held up by regulatory checks in India.

- High charges: Every intermediary in the chain charged a fee. By the time the payment reached the exporter, a significant portion of the revenue was eaten away, reducing margins on already competitive products.

This era was primarily built for large B2B transactions, where the sheer size of the trade made the inefficiencies somewhat tolerable. Speed and transparency were luxuries, not expectations.

However, as India’s entrepreneurial ecosystem grew and smaller businesses began exploring global markets, the limitations of this bank-only system became glaring. Emerging exporters needed faster, more transparent, and cost-effective solutions but the infrastructure was still designed for an era dominated by traditional banking giants.

The cracks were starting to show, signaling the need for innovation, a shift that would eventually pave the way for Cross-Border 2.0.

Cross-Border 2.0: Innovation Starts to Reshape Payments

As Indian exporters and online sellers began reaching global customers in the late 1990s and early 2000s, some innovation started happening in cross-border payments. This shift was driven primarily by two major requirements:

1. Large B2B and D2C selling through websites

Exporters and sellers wanted to accept payments directly from international buyers via cards or online platforms and settle the funds back in India. Traditional banking channels were slow, costly, and opaque, creating an urgent need for alternative solutions. PayPal, established in 1998, emerged as a prominent player, offering a simple, digital-first way to pay and get paid globally.

2. A focus on sellers’ preferences

It wasn’t enough to cater only to buyers’ needs. Indian merchants needed efficient ways to accept payments from foreigners visiting India, NRIs living abroad, and international buyers interacting digitally. This created opportunities for local payment gateways (PGs) like PayU, BillDesk, Stripe and other early players. These systems allowed Indian merchants to accept international cards and receive settlements in India, enabling smoother cross-border commerce.

Marketplaces Seize the Opportunity

Marketplaces, already operating internationally, realized they could serve as intermediaries between Indian sellers and global buyers. Platforms like e-commerce marketplaces or aggregator systems began accepting payments on behalf of Indian merchants locally overseas and settling the funds in India through SWIFT. Companies like Payoneer, as well as several Chinese players, entered the space. Many of these systems had roots in US-based marketplaces like eBay and Amazon, designed to facilitate payments from overseas buyers to manufacturers and suppliers in China. Seeing the potential in India, these players launched systems for Indian merchants, making it easier to sell internationally.

The Regulatory Gap

With simplified regulations and growing global trade, PayPal and other PGs enabled direct payments when merchants and buyers interacted directly. Meanwhile, Payoneer and other marketplace-driven systems handled transactions when buyers interacted with marketplaces, rather than individual merchants. Overseas accounts started being issued to collect these payments, offering convenience and efficiency.

Major challenges

Despite these innovations, there were regulatory concerns. Many of these overseas accounts were not regulated under Indian law. According to RBI guidelines and FEMA, such systems weren’t permitted to operate outside the domestic regulatory framework without compliance. This created a gray area, where payments were flowing in ways that weren’t fully recognized by Indian authorities, posing risks for both merchants and financial institutions.

In summary

Cross-Border 2.0 represented a huge leap forward from the bank-only era. For the first time, Indian sellers had multiple avenues, direct PGs for card acceptance, marketplace-linked solutions for global buyers, and overseas accounts for digital collection. While these innovations accelerated international trade and lowered friction, they also highlighted the need for regulation, transparency, and compliance, setting the stage for the next evolution in cross-border payments.

The regulatory blind spot How ever was the ticking time bomb of Cross-Border 2.0.

Cross Border Payments 3.0- Post Pandemic Era

The pandemic changed everything. Social commerce exploded, marketplaces boomed, and cross-border payments surged like never before. But with scale came scrutiny.

The OPGSP guidelines, originally introduced in 2015, suddenly took center stage. Compliance became the new buzzword.

The problem? Most foreign players had little appetite for Indian compliance. Their platforms were built for the US, Europe, UK where transactions flow freely without documentation, limits, or regulatory hurdles. India, with its unique restrictions on current and capital accounts, needed a different playbook.

Foreign payment providers weren’t interested in rewriting their systems for India. And that’s when a new chapter began.

The Birth of BRISKPE

In 2022, at the idea stage, BRISKPE was conceived not just to enter the cross-border payment ecosystem, but to reimagine it entirely. While the market was evolving, several Indian companies were entering the space, often adapting models inspired by foreign competitors. These solutions enabled international transactions but often lacked alignment with Indian regulations and compliance standards, creating potential risks for exporters.

BRISKPE approached the challenge differently. Instead of replicating existing systems, the team asked a simple but powerful question:

“What if we solved exporters’ problems directly, instead of making small tweaks to existing models?”

This mindset became the foundation of Cross-Border 3.0, a new era in India’s cross-border payments. BRISKPE’s mission was clear: build a system centered on the needs of Indian exporters, combining speed, transparency, and full compliance with RBI and FEMA guidelines.

By rethinking the fundamentals, BRISKPE introduced innovations that addressed real pain points: faster settlements, complete visibility into funds, and simplified global collections. Unlike other Indian players who largely mirrored foreign models, BRISKPE’s approach was India-first, designed to empower businesses to scale globally with confidence and compliance.

Cross-Border 3.0 is more than a product, it’s a movement. It marks a shift from adapting foreign-inspired systems to creating a payments ecosystem that serves Indian exporters directly, setting new benchmarks for speed, transparency, and trust.

With these changes, BRISKPE is reshaping the landscape of cross-border payments in India, helping exporters compete globally while staying fully compliant with local regulations.

Why the Old Systems Weren’t Enough

Before BRISKPE, fintech accounted for less than 5% of cross-border payments. Banks still dominated, with all their inefficiencies.

Foreign players offered slightly faster alternatives, but they:

- Ignored Indian regulatory frameworks.

- Provided limited support for compliance, such as EDPMS closures.

- Lacked transparency and real-time visibility for exporters.

The result? Exporters were left in limbo faster than banks, yes, but still burdened with hidden fees, delays, and documentation headaches.

How BRISKPE Changed the Game

BRISKPE didn’t just enter the market, it changed the narrative, focusing squarely on exporters.

1. Transparency

- No hidden fees. No guesswork. Exporters see exactly what they’ll receive, upfront.

2. Speed and Accessibility

- Real-time mobile app access.

- Over 70% of payments settle within 18 hours, a massive leap from traditional delays.

- If UPI can show instant status, why not cross border trade transactions?

3. Compliance on the Go

- Real-time FIRC generation.

- Direct EDPMS closure integrated into the system.

- Support for all other export payment documents, no more running from office to office.

4. Exporter-Centric Approach

- Instead of tweaking foreign models, BRISKPE built a system designed for India’s exporters and regulatory landscape.

BRISKPE’s vision is simple but transformative: empower Indian exporters to operate globally with speed, transparency, and confidence, while staying fully compliant. Cross-Border 3.0 isn’t just the next step in payments; it’s the future of India’s export ecosystem.

The Bigger Picture

The story of cross-border payments in India is really the story of three eras:

- Cross-Border 1.0: Banks ran the show. Slow, costly, opaque.

- Cross-Border 2.0: Innovation arrived but mostly imported from foreign players who ignored India’s unique needs.

- Cross-Border 3.0 (BRISKPE): A system built for India, by India, with exporters at the center.

In many ways, BRISKPE represents what Indian fintech has always done best: take a complex, broken system, and rebuild it with technology, transparency, and compliance.

Looking Ahead

India’s cross-border payments have evolved significantly over the years. Cross-Border 1.0 was dominated by banks slow, opaque, and expensive leaving exporters with little visibility or control. Cross-Border 2.0 introduced digital payment gateways, marketplaces, and fintech solutions, making international transactions faster and more accessible, though many systems were still inspired by foreign models and not fully aligned with Indian regulations.

Cross-Border 3.0, led by BRISKPE, marks a new era: India-first, exporter-centric, and fully compliance-driven. By focusing on transparency, speed, and regulatory alignment, BRISKPE has created a payments ecosystem that empowers Indian exporters to scale globally with confidence. From traditional banking to foreign-inspired fintech, and now to a system designed specifically for India’s exporters, the journey reflects progress, innovation, and a vision for the future of global trade.